7 Finance Career Types: With a Finance Qualification

The financial field of work offers a variety of career paths that goes beyond simply managing money. You can work face to face on a personal level with a particular client to corporate finance working on the behalf of shareholders, primarily dealing with funding sources and investment decisions.

Here’s a list of the top seven careers in finance that you might be interested in:

| Career | Salary | |

|---|---|---|

| 1 | Financial analyst | $110,000 |

| 2 | Accountant | $92,469 |

| 3 | Financial planner | $98,647 |

| 4 | Financial advisor | $100,000 |

| 5 | Bank teller | $68,536 |

| 6 | Asset manager | $113,325 |

| 7 | Portfolio manager | $120,840 |

1. Financial analyst

For finance majors, a great option is to become a financial analyst. They work with individual investors and companies to produce analytical reports and projections to identify potential financial risks.

They do this by reviewing past and current financial data and any sort of financial movements in order to compile guidance to maximise profits. Researching financial markets to analyse trends and make informed decisions are also common practice in the risk management business.

2. Accountant

Accountants are the people who manage their client’s financial statements and file financial and tax reports on their behalf. Their main duties include ensuring that their client’s taxes are paid on time, send invoices, prepare budgets and keep a record of disbursements.

The most common type of accountant is a public accountant, who work for either an individual or institution, helping them file their tax returns and perform audits. If you become an accountant, you will have to work with various other people, such as auditors and financial planners, not to mention you’ll have to review legal principles relevant to your reports.

3. Financial planner

Certified financial planners are people who focus on achieving the long-term goals of an individual or company. While they are quite similar to financial advisors, the latter is much a broader position that generally helps their client manage their money across other accounts. Technically speaking, financial planning is a type of financial advisor, who are more specialised in a particular area in investments, estate planning or taxes.

There are lots of financial planning courses out there, both free and paid. The one that’s right for you depends on your situation, but if you’re new to the industry, a Diploma in Financial Planning is one of the best ways to get a foot in the door.

4. Financial advisor

If you decide to become a financial advisor, the crux of your role will be helping clients create individualised plans to achieve their specific financial goals. Financial advisors often work in tax planning, savings, budget, insurance, superannuation, real estate, retirement planning and investment management.

When writing up a financial plan, a financial advisor will have to include the current net worth, working capital and assets. They hold meetings with their clients regularly to review their situation and their goals constantly.

5. Bank teller

What is considered to be an entry level position, a bank teller is someone who typically greets the customer as soon as they enter the bank and is the first person to help them with whatever financial problem they may have.

Their main duties are to exchange money, take cash, checks and other forms of payments from customers to store in their accounts and electronically record each transaction made. They’re also responsible for the cash in the drawer, meaning that they have to count the money when they start their shift and when their shift ends.

6. Asset manager

Asset managers monitor any resources owned by the business they work for. Their main goal is to increase asset values, and often work independently to maximise revenue. They work with their clients to make investment decisions to expand their portfolio using macro and microanalytical tools.

In order to make the correct decisions, asset managers will have to undertake a statistical analysis of the financial market and discussions with company officials.

7. Portfolio manager

A professional who is involved in financial management, a portfolio manager oversees investment portfolios for their clients. They discuss different strategies and the overall performance with their clients and work alongside a team of financial analysts to identify the strategy for their client’s particular portfolio.

In fact, portfolio managers often start off as financial analysts and many have a master’s degree in business administration or finance, though it isn’t necessary for the position. In short, much of their work revolves around exchange-traded, mutual or closed-end fund’s assets.

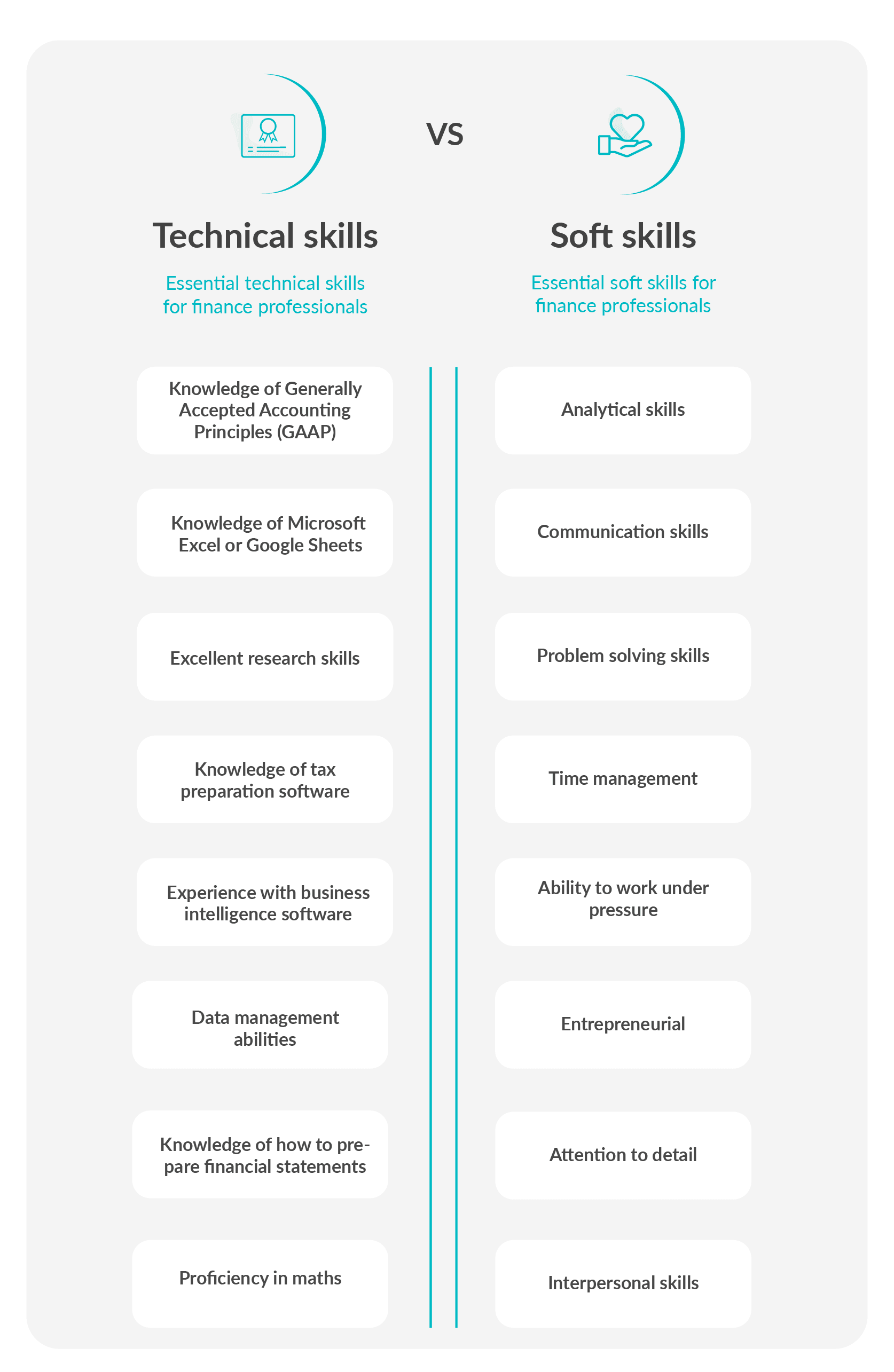

Finance professional skills and qualities

Technical skills:

- Knowledge of Generally Accepted Accounting Principles (GAAP)

- Knowledge of Microsoft Excel or Google Sheets

- Excellent research skills

- Knowledge of tax preparation software

- Experience with business intelligence software

- Data management abilities

- Knowledge of how to prepare financial statements

- Proficiency in mathematics

Soft skills:

- Analytical skills

- Communication skills

- Problem solving skills

- Time management

- Ability to work under pressure

- Entrepreneurial

- Attention to detail

- Interpersonal skills

All of these careers require a finance degree, usually a bachelor’s degree in finance, accounting, economics, business or any other related field. Short courses may be needed to increase your employability prospects along with the proper work experience.